Frequently Asked Questions (FAQ)

Half-Cent Surtax FAQs

25 counties – Alachua*, Bay, Brevard*, Calhoun, Clay*, Duval*, Escambia, Flagler, Hernando*, Hillsborough, Jackson, Lee, Leon, Manatee*, Martin*, Monroe*, Okaloosa, Orange*, Osceola, Polk, St. Johns, St. Lucie*, Santa Rosa, Volusia, Washington.

- 52% of all public school students in Florida

*10 counties have both the half-cent surtax and additional voted millage

In the 2023-2024 fiscal year, the half-cent surtax generated $37 million.

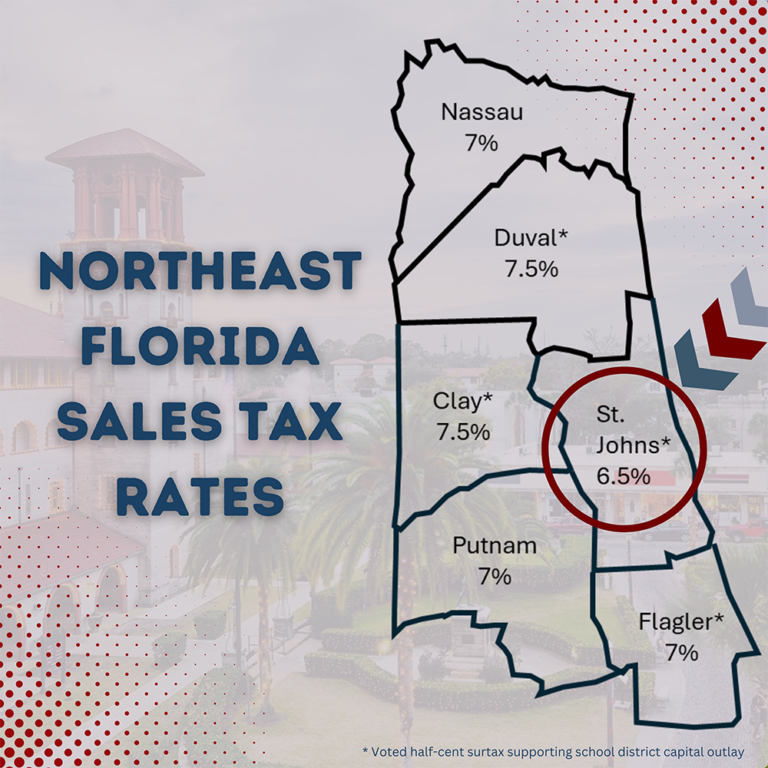

- Nassau – 7%

- Duval – 7.5% (with half-cent surtax)

- Clay – 7.5% (with half-cent surtax)

- St. Johns – 6.5% (with half-cent surtax)

- Putnam County – 7%

- Flagler – 7% (with half-cent surtax)

The half-cent is a renewal of an existing surtax. It will not cost residents any additional money.

No, it is assessed on the first $5,000 of a large purchase and is capped at $25.

No, Florida Statute 212.055(6) limits school districts to a half-cent levy and specifies the use for capital purposes only.

The voters passed the half-cent in 2015, for a period of 10 years. The measure sunsets on December 31, 2025. State statute now requires that the referendum take place during a general election. If the district waited until the next general election in 2026, there would be a gap.

We cannot afford for the half-cent not to pass in November, but if it does not, the district would fall further behind on construction of new schools, be forced to defer some major maintenance projects on existing facilities, and fail to keep pace with technology innovations to serve our students. No matter what we cannot ever compromise on school safety.

Additional Operating Millage FAQs

25 counties – Alachua*, Brevard*, Broward, Charlotte, Clay*, Collier, Dade, Duval*, Franklin, Hernando*, Indian River, Lake, Manatee*, Marion, Martin*, Monroe*, Nassau, Orange*, Palm Beach, Pasco, Pinellas, St. Lucie*, Sarasota, Taylor, Walton

- 63% of all public school students in Florida

*10 counties also have half-cent and additional millage

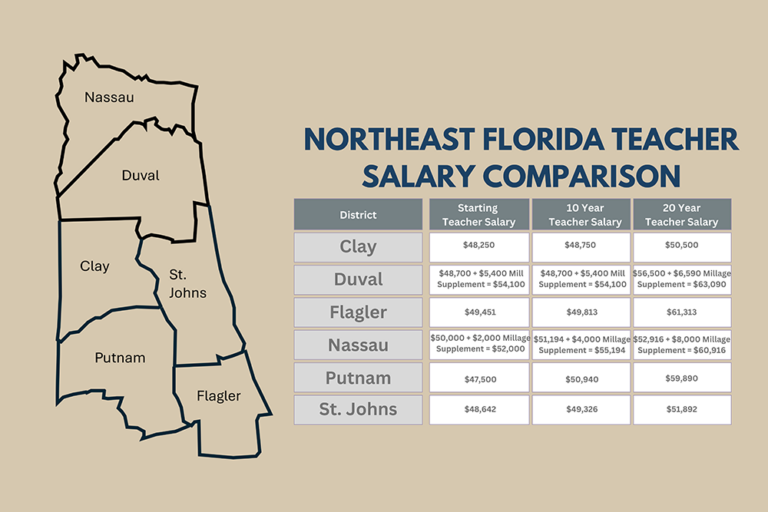

- Duval County – $48,700 Base Salary + $5,400 Millage Supplement = $54,100

- Nassau County – $50,000 + $2,000 Millage Supplement = $52,000

- Flagler County – $49,451

- St. Johns County – $48,642

- Clay County – $48,250

- Putnam County – $47,500

- Duval County – $5,401 – $7,041 depending on experience.

- Nassau County – $2,000 – $10,000 depending on experience

85% of the money will be used for salary improvements to retain and recruit the best staff to serve students. The remaining 15% will support school safety, student welfare, and program enhancements.

If in the future the millage was not renewed, the current school funding formula would not be able to sustain a permanent salary adjustment.

The committee will be similar in structure, but will operate independently of the Half-Cent Sales Tax Citizen Advisory Committee and will be made up of different members.

Florida’s Statute 1011.73 requires school district millage elections to be held in a general election. Multiple counties in Northeast Florida passed additional millages in 2022. Current funding methods do not allow us to offer competitive salaries to attract and retain the best staff to support our students.

Current funding will not sustain the level of services that the district provides. Reprioritization of resources will likely result in reductions in some areas.

Collections will begin in July 2025 and continue through June 2029.

By the Numbers

While St. Johns County School District is consistently rated a “A” school district, its teacher placement salaries are comparably lower than those of adjoining counties. A single mill increase will help the district offer competitive salaries to attract and retain the best teachers for our children.